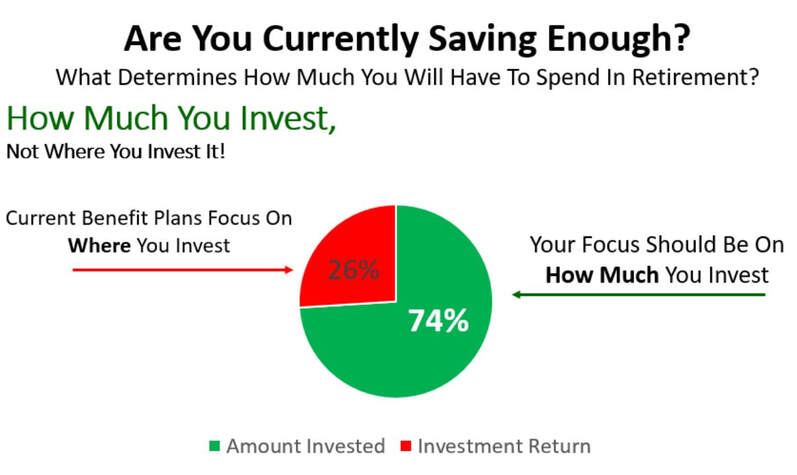

How to Retire with 60% to 90% More Income!

(It’s not where you invest….it’s how much you invest)

|

|

Watch this video link instead if you are in the medical profession:

What Top Experts Are Saying about Kai-Zen

“No plausible economic scenario broke the [Kai-Zen] plan - it would have to be something totally out of the ordinary.”

-Actuary, with one of the top insurance carriers

“Kai-Zen is the most compelling option I have seen in my search for a solution to maintain my current lifestyle in retirement."

-Head of Private Bank Life Insurance - Leading top 10 largest U.S. Bank, Client of Kai-Zen

|

See What Clients Are Saying about Kai-Zen

Kai-Zen’s client base represents a variety of professionals who are enthusiastic about their plan. Listen to what these clients have to say who really understand the unique value delivered by Kai-Zen and why they participate in this strategy.

Source: Retirement Success: A Surprising Look into the Factors that Drive Positive Outcomes by David M. Blanchett, QPA, QKA, and Jason E. Grantz, QPA

Overcoming The Top Two Financial Concerns

There are other benefits to the Kia-Zen plan than just saving for retirement. Research shows that the top two concerns American’s have today are:

The life insurance policy under a Kai-Zen plan also offers protection for you and your family in the event of your absence, a chronic illness, or terminal illness. An extended illness can happen to anyone at any time. In fact, 40% of the people who are receiving extended (or long-term) care today in the US are under the age of 65. You can achieve peace of mind for yourself and your family knowing that in case something happens, your family will be protected financially.

- The inability to afford to retire comfortably

- Medical emergencies that would wipe out their savings

The life insurance policy under a Kai-Zen plan also offers protection for you and your family in the event of your absence, a chronic illness, or terminal illness. An extended illness can happen to anyone at any time. In fact, 40% of the people who are receiving extended (or long-term) care today in the US are under the age of 65. You can achieve peace of mind for yourself and your family knowing that in case something happens, your family will be protected financially.

What Makes Saving For Retirement So Hard?

Why is it that 90% of us are chronically under saving vs what we should be saving to maintain the lifestyle in retirement we promised ourselves? According to research by Fidelity, Mercer and Aon, if you start saving in your mid-forties, to maintain lifestyle in retirement you need to save at least 35% of what you make. The average amount saved amongst professional groups is more like 9-15%. So, you can see the problem: there is simply not enough money in your retirement account to solve the issue.

If there is not enough money being saved for you to have the lifestyle you enjoy and aspire to maintain, then we just need to bring more money to the table. Leverage, when done correctly, may just be the cheapest and most sustainable source of the money needed to have enough capital to achieve our objectives.

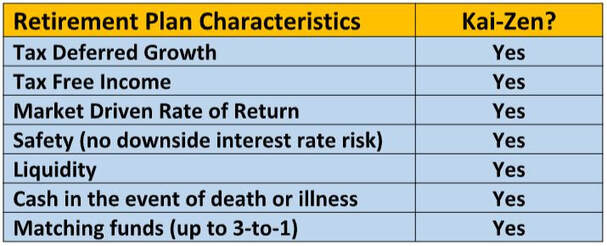

Why Kai-Zen is Ideal for Retirement Planning

If you could choose your ideal retirement plan, what advantages would you want it to have? Like most people, there would be a number of “wish list” items you would want it to achieve. Take a look at what a Kai-Zen plan can offer.

While this is a great list, one item that most people would like to add is “deductibility”. While Kai-Zen does not offer this advantage inherently, our Tri-Zen plans does! See the information later on this page about our Tri-Zen product

As you learned in the introduction video, the Kai-Zen plan can achieve up to a 3:1 ratio with matching funds from our preferred set of lenders. Nothing on the market offers this much of a match! There are no limits imposed on the amount of money you can contribute as there are with “qualified” plans (IRA’s, 401(k)’s, 403(b)’s, etc). There are some policy limits which relate to how much you can contribute to a policy as premiums and still have the option for tax-free distributions.

As you learned in the introduction video, the Kai-Zen plan can achieve up to a 3:1 ratio with matching funds from our preferred set of lenders. Nothing on the market offers this much of a match! There are no limits imposed on the amount of money you can contribute as there are with “qualified” plans (IRA’s, 401(k)’s, 403(b)’s, etc). There are some policy limits which relate to how much you can contribute to a policy as premiums and still have the option for tax-free distributions.

How Do We Accomplish These Objectives?

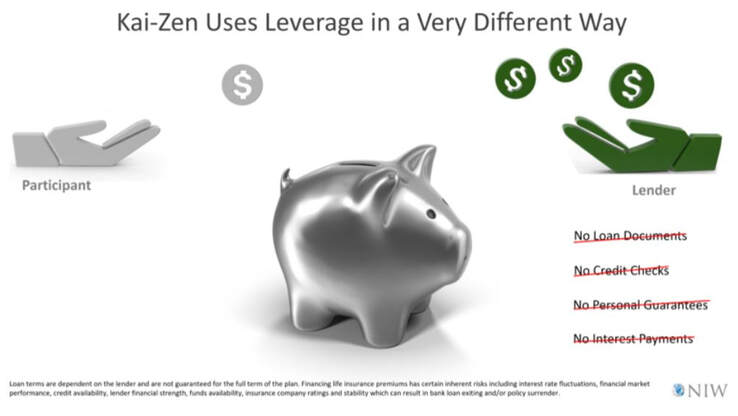

We utilize the concept of Premium Financing which employs the use of a life insurance policy in which the premiums are paid by financial institutions on behalf of the insured or owner of the policy. The payments are loans which are provided through third party finance firms known as premium financing companies. Typically, these firms consist of large, well-capitalized banks and banking networks.

It’s All About the Right Kind of Leverage

Many of us already use “leverage” when buying a home or other major purchase because we utilize loans to buy larger or more expensive items. The wealthy use leverage extensively to build their wealth. It is a common practice and widely accepted in our modern financial world. We follow the same principle with Kai-Zen. We teach you how to use leverage in your retirement planning to achieve 60% to 90% more in retirement income than you could otherwise achieve by using just your cash. See the chart below for a demonstration of the leverage (approximately 3:1) we employ with Kai-Zen.

How Does Leveraging Help?

More Cash to Buy More Benefits!

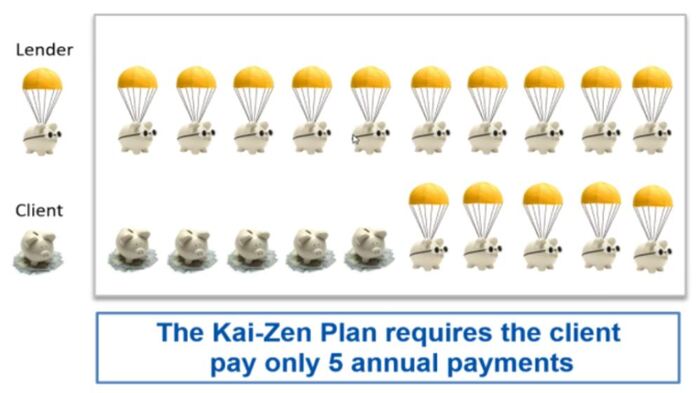

We only require the owner of a Kai-Zen plan to make (5) annual payments and you’re done! The bank also matches your five payments in the first five years. Then the bank funds both your part and the bank’s part for the next 10 years. This is the “secret sauce” and how we can achieve a 60% to 90% increase in retirement income. This is leverage at its best!

What Makes Us Unique in the Premium Finance Marketplace?

The concept and implementation of premium finance strategies are not new. In fact, they have been utilized for over 50 years for high net worth individuals and business owners. There are several well-respected firms in the industry including our premium finance partnering companies. However, not all these firms offer the same level of service nor do they offer the same extent of benefits as we do. Our strategies offer various approaches which are based on whether the plan is for an individual or business owner -OR- if the plan is for a business owner(s) to include key employees as well.

With our strategy using the bank is a much safer and less restrictive approach than with other premium finance programs. We are the only program which does not require you to sign any lending documents. There are no collateral requirements either. How is this possible? The life insurance policy becomes the collateral in which you and the bank share in the growth of the policy. The loan and interest is paid off in year 15 leaving the remaining cash to be used for your retirement income. And this can be a very substantial amount since you used leverage to fund your policy!

With our strategy using the bank is a much safer and less restrictive approach than with other premium finance programs. We are the only program which does not require you to sign any lending documents. There are no collateral requirements either. How is this possible? The life insurance policy becomes the collateral in which you and the bank share in the growth of the policy. The loan and interest is paid off in year 15 leaving the remaining cash to be used for your retirement income. And this can be a very substantial amount since you used leverage to fund your policy!

You probably used a mortgage to buy a home…. why not use the same concept with your retirement savings?

|

Program 1: Kai-Zen Plan

Business Owner or Individual

This plan is for an individual business owner or owners with independent plans or any individual meeting the program requirements. Kai-Zen was uniquely designed to combine the advantage of leverage with the cash accumulation features of life insurance. This enhances your potential for policy distributions during retirement to supplement your income while also providing more protections for your family.

Program 2: Tri-Zen Plan

Business Owner(s) Including Key Employees

The difference between the Kai-Zen plan and the Tri-Zen plan is that Tri-Zen is for business owner(s) with 15+ key employees to include in the plan. Please watch the Video below since it relates to the use of BOTH programs 1 and 2.

Kai-Zen and Tri-Zen are game changers when it comes to recruiting qualified employees and retaining your top talent. Click on the video link below for an overview of how these strategies can impact your bottom line.