Insuring Hidden Risk and Creating Better Cash Flow

|

Most business owners unknowingly self-insure a large amount of risk. Many of these are hidden or “below the surface” risks inherent in the operation of a business.

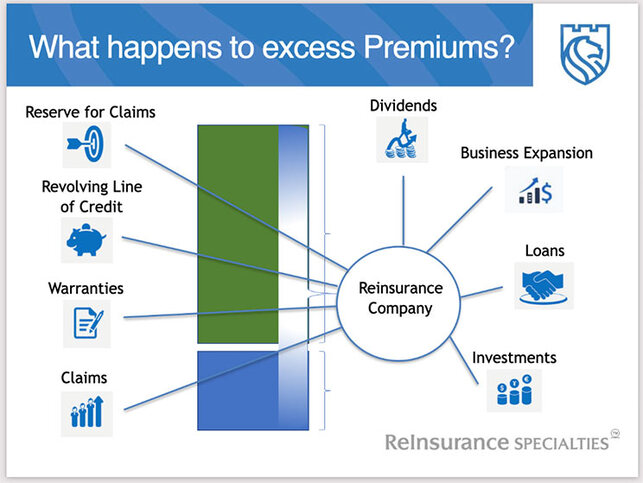

Any material risks can be insured. If insurance claims are as projected, the reinsurance company (captive) will retain profits that can be distributed to its owners. |

If you don’t have an alternative risk transfer program in place, you may soon be in the minority. Insurance industry trends indicate that most middle market businesses will implement a captive or alternative risk transfer strategy over the next few years. In fact, 92% of Fortune 500s use some form of a captive.

Important Factors to consider with Reinsurance:

1) Risk Management - the client chooses to mitigate their own risks and manage any claims...which takes about 15 minutes per quarter/year.

2) Asset Protection - the client's newly-created insurance company is domiciled with tribal sovereignty...versus a foreign country with regulatory conditions.

3) Wealth-Building - the client remits tax-advantaged premium into their newly-formed entity that they manage with turnkey support.

2) Asset Protection - the client's newly-created insurance company is domiciled with tribal sovereignty...versus a foreign country with regulatory conditions.

3) Wealth-Building - the client remits tax-advantaged premium into their newly-formed entity that they manage with turnkey support.

What is Reinsurance?

Advocated by President Ronald Reagan (1986), this platform encourages US businesses to strengthen their risk position through reinsurance.

Self-insurance (reinsurance) is a smart way to fill gaps in insurance while taking advantage of powerful planning benefits. In general, Business Owners can form their own bona fide insurance companies to insure their uninsured and under-insured business risks while protecting assets and building wealth.

Self-insurance (reinsurance) is a smart way to fill gaps in insurance while taking advantage of powerful planning benefits. In general, Business Owners can form their own bona fide insurance companies to insure their uninsured and under-insured business risks while protecting assets and building wealth.

Is it popular?

Forming a reinsurance company allows businesses to create a dedicated asset base to fund losses, improve cash flow, and provide investment income.

It is why 92% of Fortune 500 businesses own at least one captive and 70,000+ mid-sized companies have also adopted this risk management strategy.

The thinking of many risk managers is simple: Why send all risk-related premium to an external party if congress allows for our business to self-manage risks and enjoy the underwriting profit?

It is why 92% of Fortune 500 businesses own at least one captive and 70,000+ mid-sized companies have also adopted this risk management strategy.

The thinking of many risk managers is simple: Why send all risk-related premium to an external party if congress allows for our business to self-manage risks and enjoy the underwriting profit?

Watch Our Videos

Watch these short videos to learn more about the strategy and how to implement a

Reinsurance plan for your own business.

Reinsurance plan for your own business.

|

SHORT Version (3 min)

|

LONG Version (9 min)

|

(Note: Reach out to Lifestyle Income Strategies for more information and we will initiate any contact on your behalf with Reinsurance SpecialtiesTM).

About Our Trusted Parter

Lifestyle Income Strategies works closely with Reinsurance SpecialtiesTM, a leading firm in the establishment and management of Producer Owned Reinsurance Companies for business leaders.

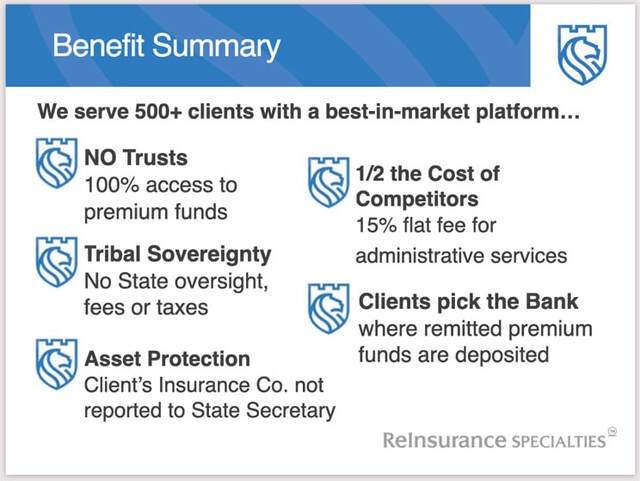

Key competitive advantages:

a) Our clients (Business Owners) enjoy the lowest one-time capitalization in the market: $14,990.

This amount completes Company Formation, domiciles Company with one of our tribal partners and commissions a certified actuary to review company(s) risk profiles (this can represent multiple LLCs; the policy is derived from this third-party actuarial report satisfying IRS compliance).

b) Reinsurance Specialties™ does NOT use a Trust, Trustees, or a Trust Agreement.

Unlike other Reinsurance service providers, our clients' premium funds reside in the FDIC bank of their choice. The client has 24/7 access to his/her monies and determines the signees on respective bank account.

c) Because Reinsurance Specialties™ domiciles with the Sac & Fox Nation or Modoc Nation, the client's Insurance Company is never subject to state regulations, oversight, or fees/taxes. Our clients enjoy tribal sovereignty.

d) On average, Reinsurance Specialties™ is 1/2 the cost of our competitors. Our modest flat rate percentage represents professional Administrative Services to include accounting, year-end tax filing, investment consultation, loan structuring, loan processing and claims management.

This amount completes Company Formation, domiciles Company with one of our tribal partners and commissions a certified actuary to review company(s) risk profiles (this can represent multiple LLCs; the policy is derived from this third-party actuarial report satisfying IRS compliance).

b) Reinsurance Specialties™ does NOT use a Trust, Trustees, or a Trust Agreement.

Unlike other Reinsurance service providers, our clients' premium funds reside in the FDIC bank of their choice. The client has 24/7 access to his/her monies and determines the signees on respective bank account.

c) Because Reinsurance Specialties™ domiciles with the Sac & Fox Nation or Modoc Nation, the client's Insurance Company is never subject to state regulations, oversight, or fees/taxes. Our clients enjoy tribal sovereignty.

d) On average, Reinsurance Specialties™ is 1/2 the cost of our competitors. Our modest flat rate percentage represents professional Administrative Services to include accounting, year-end tax filing, investment consultation, loan structuring, loan processing and claims management.

e) Most of our clients (Business Owners) make investments or loan monies out of pre-tax structure representing investments, business expansion, real estate acquisition and more.

Who is Reinsurance Specialties™?

Reinsurance Specialties™ (and their service companies Creditors Captive Formation Company™ and Specialty Insurance™) employs dozens of seasoned experts serving clients/successful business leaders generating between $1M to $800M in annual gross revenues in many different markets.

We help insureds/business leaders remit tax-advantaged premium in various industries ranging from Automotive to Construction to Energy to Medical to Agribusiness to Law to Retail to Real Estate to Financial Services.

We help insureds/business leaders remit tax-advantaged premium in various industries ranging from Automotive to Construction to Energy to Medical to Agribusiness to Law to Retail to Real Estate to Financial Services.

Contact us to learn how you can utilize a Reinsurance strategy to better manage and control your business risk, create more positive cash flow, and utilize tax-advantaged premiums to fund your captive insurance company.

Here is a link to our Calendar to set up a discovery meeting

Here is a link to our Calendar to set up a discovery meeting